Medical Affairs is both a rewarding and challenging area in the evolving environment of drug development and launch readiness planning. Increased scientific, clinical, regulatory, and payer requirements to demonstrate clinical value and product differentiation in increasingly well-established therapeutic areas heightens the demand for an evidence package that clearly fulfills unmet medical need, and justifies cost. In bridging the product from the R&D/Clinical Development Team to the Launch Team for phase IIIb/IV clinical development, Medical Affairs takes on the broad responsibility of Scientific and Clinical Expert to support the commercialization process.

As the pharma function with the remit to lead late phase clinical development programs, and build relationships through scientific and clinical exchange with academic thought leaders, community physicians, investigators and collaborative groups, Medical Affairs is a highly externally focused function. Medical Affairs’ external liaising informs and supports launch planning to ensure that pharma addresses true clinical and patient needs along the launch path. In addition, it is Medical Affairs that commonly leads the charge in organizational education and training about disease or product mechanism of action and data across Global, Regions and Countries, so that Medical Science Liaisons (MSLs) and Sales Representatives can attain the required standard of knowledge for informed and value-add external stakeholder interactions.

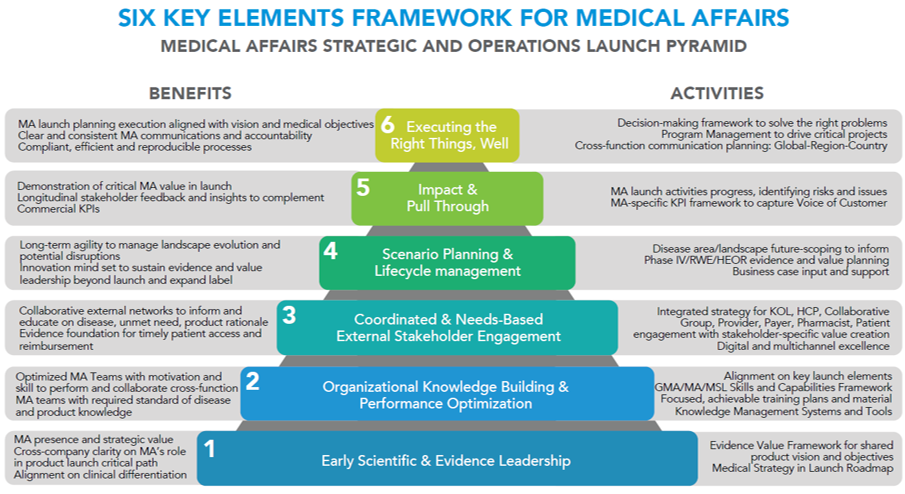

This article describes a recommended framework outlining what we believe are the six key elements that Medical Affairs Leadership and Team Members should take account of in strategic and operations to support product launch, so that the clinical value of the product can be realized by the target patient population, and therefore achieve launch success.

1. Early scientific and evidence leadership

The increase in same-class molecules in clinical development for the large therapeutic areas and patient populations has made scientific and clinical differentiation particularly challenging. A common scenario is that pharma companies are launching a new product where competitor same-class products have more indications and/or are already established in terms of safety. Similarly, problematic for Medical Affairs Teams is supporting commercialization where there has been a regulatory thin development program, giving a sub-optimal clinical evidence package for regulatory authority submission. This issue is compounded by intense industry-wide business development and merger and acquisition activity, which typically means limited opportunity for input to early plans for evidence generation. Adding to the complexity, is the interest among providers and payers in applying frameworks to critically assess and compare the value of therapeutic options. Taking oncology, for example, there are already many professional organization- and institution- endorsed value frameworks in play, each with varying levels of current awareness and utility among physicians and payers.1 A key consequence for Medical Affairs of the desire for robust value evidence is the need for earlier planning around health economic outcomes research (HEOR) data to support therapeutic effectiveness and justify cost, as well as early integration of the patient flow and patient-centered outcomes data in clinical trial programs.

Consequently, as part of early phase of launch preparations, Medical Affairs, in association with other functions, must assess and decide where to invest in real-world evidence generation to support value, through quality of life studies, Investigator-led studies, and patient reported outcomes studies, to back up clinical value at launch and beyond. Strategically, this means that Medical Affairs Leadership must provide clarity on the optimal evidence and value framework for launch teams, as well as best practices for the development of Medical Strategy and the Launch Roadmap for Medical Affairs-specific activities. Operationally, this necessitates absolute clarity on Medical Affair’s role and remit in the product launch critical path and Launch Team, setting out how decisions will be made cross-functionally, with R&D/Clinical Development, Commercial, Regulatory Affairs, Pricing and Market Access, and Patient Relations.

2. Organizational knowledge building and performance optimization

Once given the green light to commercialize and launch, the Medical Affairs Executive Team should seek to establish and foster Medical Affairs teams with the size, scale, and culture designed for optimum performance. Identifying the strengths and weaknesses of the organization’s launch teams at Global, Regional and Country levels, as well as existing programs, is a logical starting point here, and benefits from an objective review. An integral part of this review should consider the implementation of Global Medical Affairs/Medical Affairs/MSL Skills and Capabilities Framework and operating models. This process invariably uncovers pivotal opportunities and barriers to enabling Medical Affairs’ success in supporting the overall launch planning process.

In instances where the plan is to launch a product in a therapeutic area or patient population with no or little prior institutional therapeutic area or product knowledge, there is great need to educate and re-educate company personnel. In general, the importance of Medical Affairs in leading organizational understanding building across Medical Affairs and Commercial, cannot be underestimated.

For Medical Affairs Executives, a commitment to defining and hiring the optimal Medical Affairs teams with the experience, skills, and resources to support company-wide training and education on disease state, product MOA, product data and patient benefits, and prioritized programs and activities, is business critical.

As a key healthcare professional (HCP)-facing pillar of the company, operating models to ensure field teams receive training on, and real-time access to, the latest therapeutic area and product knowledge, with optimized skills, processes and systems to feedback valuable customer insights through Knowledge Management Systems and Tools and CRM platforms, will build and sustain a valuable customer-company

dialogue aligned to the launch vision and medical objectives.

3. Coordinated and needs-based external stakeholder multichannel engagement

As part of building the foundation for launch, significant Medical Affairs time and effort is invested in strategies to identify, profile and engage with HCPs, in particular academic and expert Key Opinion Leaders (KOLs), as these experts inform strategy and planning, and support community education on disease, unmet need, and product rationale, and play a role in shaping the treatment algorithm.

Similarly, the planning and development of key materials for multichannel medical education and engagement are key Medical Affairs priorities.

What is striking is how much the external stakeholder base for Medical Affairs has dramatically widened in recent years, becoming more segmented and sophisticated as treatment pathways become ever more complex. As an example, Medical Affairs launch planning in Infectious Disease (ID) may need to consider: academic and community ID Specialists, General Practitioners, Investigators and Collaborative Groups, Pathologists, Providers, Payers, Pharmacists and Public Policy Makers, patient advocacy groups, among others, depending on the disease and its multi-disciplinary management. Knowing how to prioritize and optimally cadence stakeholder-specific value creation in communication platforms and channels specific to the needs and roles in the treatment value chain, is essential. It is all too easy to wrongly assume that new stakeholder groups will need and value the same type of engagement with pharma as traditional stakeholder groups.

At the enterprise level, Medical Affairs should strongly consider all possible multichannel capabilities in order to select, design and execute the optimal multichannel educational strategies. Early and well-orchestrated collaboration and co-ordination with the regions and countries provides vital insight to inform the optimal development and implementation of multichannel education and communication programs. More often than not, launch may involve critical components such as a companion diagnostic for a precision medicine therapy, or a connected health or mHealth platform, for example where maximum patient adherence is imperative. In such instances, proactive and focused company-wide co-ordination will greatly maximize the value of Medical Affairs interactions with HCPs about the therapeutic area and launch product across all launch program elements.

4. Scenario planning and lifecycle management

With so much to achieve prior to launch, a key challenge can be not paying enough attention to risk mitigation and expecting the unexpected, both in the product’s clinical development program and in the therapeutic area in general. For some Medical Affairs teams, being too short-term focused and not exploring possible events, their probability and impact on their launch plans, can be detrimental. When product launch is too internally focused, the therapeutic landscape and market dynamics that influence patient access to treatment, such as regulatory, diagnostics, market access, public policy and technology, may have changed. As a consequence, the launch plans may no longer align with the true needs, beliefs and behaviors of the stakeholder. This is when failure can happen.

Scenario planning is critical because there may be limited time and opportunity to course correct during the clinical trial program or other key Medical Affairs initiatives.

Long-term agility in anticipating and managing potential disease area disruptions should be a cultural mindset backed up by strategic intent and process across the organization. Typically, Commercial takes the lead in market scenario planning and future-scoping activities within the launch team. Without doubt, the most successful product launches occur when all functions, especially Medical Affairs, have a firm handle on what may change, why and when, and how this impacts key launch decision-making on strategy and tactics.

Evaluate Pharma predicts that, for the top 20 pharma companies’ recently launched and pipeline portfolios, value creation for products in existing core areas will deliver the greatest value gain between 2018 and 2024, with cumulative sales of $579bn.2 The corresponding forecast for non-core areas is $334bn. This not only highlights the importance of launch success in core areas, but also the need for launch teams to set their horizons beyond the projected launch indication and timeline, supported by frameworks and tools to facilitate lifecycle management planning. In this way, Medical Affairs teams can proactively invest in Phase IV/RWE/HEOR evidence generation and clinical development for future lifecycle label expansions, confident in their plans to sustain clinical value beyond launch and maximize lifecycle potential.

5. Impact and pull through

Ensuring there is a mechanism for measuring success in launch planning is obvious. In contrast to measuring the impact of Commercial planning and initiatives, it can be more challenging to qualify and quantify the impact of Medical Affairs’ activities, where there are strict compliance requirements for objective scientific and medical integrity in HCP engagement.

Interactions between the company Medical Affairs personnel and HCPs, whether between Global and Country MA Leaders and KOLs, or MSLs and Clinical Trial Investigators, provide critical touchpoints for capturing insights and ‘Voice of the Customer’ dialog about patient about medical need and clinical practice, science, data and information on therapeutic intervention such as efficacy and safety.

A growing area of investment by Pharma companies is in optimizing processes and governance for more structured and strategically valuable KPI collection using CRM platforms across Medical Affairs. This provides valuable feedback and insight to complement existing mechanisms for external insights, intelligence and feedback from Commercial. Not only do such systems and processes inform and direct Medical Affairs decision-making and activities planning before and after launch, but they also provide an index of the overall role and value of Medical Affairs in launch planning. One observation is that Medical Affairs KPIs are often created too late in the launch planning process, despite their importance in informing resource and planning decisions. Proactive integration of an optimized Medical Affairs KPI framework and benchmark across countries and regions sets the organization up for valuable longitudinal stakeholder feedback and insights analysis going forward. This process also provides an excellent vehicle for constructive pre-launch collaboration and planning with Country and Regional Medical Leaders to fine-tune country-level preparation.

6. Executing the right things, well

If there is one thing that Medical Affairs teams always seem to lack, it’s time. And so, selecting the right problems to solve, together with a decision-making framework to solve them, are indispensable to maximize effectiveness. In our experience, there is greater scope for Medical Affairs functions to utilize third-party support to help drive critical projects, track Medical Affairs planning progress, and proactively identify risks and issues, especially across the Global to Local axis. Program management and oversight to drive the Medical Launch activities enables Medical Affairs Leaders and Managers to focus on key decision-making for core processes, innovation and value-add initiatives that create clinical and patient value, and devote valuable time to liaison with internal and external stakeholders.

Coordinated and consistent communication planning from Medical Affairs across pharma functions in Global, Regions and Countries, as well as with other parties such as development, strategic, diagnostic, and business partners, has significant positive impact. With pharma companies increasingly reorganizing their structure around disease areas, Global and Country Medical Affairs personnel often have commitments to portfolio products or disease area on top of their pre-launch product commitments. For Global Medical Affairs, ‘competing’ for the time and attention of Affiliates with limited bandwidth is a common barrier to efficient and timely launch planning execution. Support from a third party brings best practice in providing focused and clear communication to help busy Medical Affairs teams achieve awareness and understanding of product launch vision, objectives, and key initiatives. Additionally, and perhaps more importantly, a dedicated and consistent Global-to-Local communication approach gives the right team members in the Countries and Regions a vital platform for engaged dialog exchange and synergistic momentum in execution, which really strengthens execution locally.

Medical Affairs is both strategically and operationally critical in planning, creating, and delivering differentiated scientific and clinical value in product launch readiness planning. This means Medical Affairs must establish and sustain functional effectiveness to optimally deliver the medical platform to support new and meaningful clinical value to patients. In a healthcare environment that is increasingly complex, unpredictable, and regulated, Medical Affairs should devote early focus to building strategic and operational launch success by adopting our Six Key Elements Framework.

Vynamic, an Inizio Advisory company, is a leading management consulting partner to global health organizations across Life Sciences, Health Services, and Health Technology. Founded and headquartered in Philadelphia, Vynamic has offices in Boston, Durham NC, New York, and London. Our purpose is simple: We believe there is a better way. We are passionate about shaping the future of health, and for more than 20 years we’ve helped clients transform by connecting strategy to action.

Through a structured, yet flexible delivery model, our accomplished leaders work as an extension of client teams, enabling growth, performance, and culture. Vynamic has been recognized by organizations like Great Place to Work and Business Culture Awards for being leaders and innovators in consulting, company culture, and health. Visit Vynamic.com to discover how we can help transform your

organization or your career.

Tamaron Bertelli

Tamaron Bertelli

This structured approach guides Med Affairs leaders in executing micro-transformations to drive meaningful impact for your organization and patients.

Read more Jess Werle

Jess Werle

Embrace MedTech's future by blending field and digital strategies to boost sales effectiveness, unleash the power of data, and stand out in the market

Read more Jack Young

Jack Young

Explore how leading with authenticity not only ensures success in the launch of life-saving medicines, but generates positive business results too.

Read more