The One Big Beautiful Bill Act: Implications for the U.S. Health Industry

Executive Summary

The passage of the One Big Beautiful Bill Act (OBBBA) represents a structural turning point in U.S. health and social policy. With over $1.2 trillion in federal reductions across Medicaid, the ACA, SNAP, and pharmacy benefit structures, the legislation shifts administrative and financial risk from federal agencies to providers, payers, pharmacies, and life sciences companies. The phased implementation spanning from 2025 through 2027 will fundamentally alter coverage, affordability, and operational strategy across the healthcare ecosystem.1

Systemic Shifts and Sector Impacts

OBBBA imposes capped Medicaid funding, reinstates work requirements, phases out ACA subsidies, bans PBM spread pricing, and reduces SNAP eligibility. These changes will create fragmented coverage pathways, compound social risk factors, and introduce volatility in demand and reimbursement.

- Providers will face rising uncompensated care, particularly in safety-net and rural systems, as coverage loss accelerates. Margin compression and access strain will pressure service lines and clinical staffing.

- Health Plans must absorb enrollment churn and increased risk concentration, particularly in Medicaid and ACA exchanges. Redetermination processes and subsidy loss will heighten operational and financial complexity.

- Pharmacies will experience volume decline and reimbursement model shifts due to PBM reforms and reduced public program utilization placing independent operators under consolidation pressure.

- Life Sciences companies face slower uptake for public program-reliant therapies, increased demand for real-world evidence, and strategic pressure to reprioritize pipeline assets. Medicaid pricing changes will reshape gross-to-net dynamics.

Public Health and Equity Risks

Simultaneous loss of insurance and social supports threatens to reverse recent gains in prevention and population health. Vulnerable groups especially young adults, low-income families, and rural populations will experience the sharpest decline in access. SNAP reductions are projected to worsen chronic disease prevalence and emergency care reliance.

What’s Needed Now

Health industry leaders must prepare for ripple effects that cross organizational and sectoral lines.

- Scenario planning, access strategy realignment, and value-based partnerships will be essential.

- New operating models, data integration, and affordability platforms will need to scale quickly.

- Cross-sector collaboration must become the norm to prevent fragmented care delivery.

At Vynamic, we believe this is a moment to pause with purpose—to assess the landscape, align enterprise strategy, and act decisively. Our team is ready to help clients turn this policy inflection point into a platform for long-term resilience and impact.

Detailed Perspective

Federal Health and Social Policy Reversal: Structural Shifts

The One Big Beautiful Bill Act (OBBBA) represents a decisive departure from two decades of federal efforts to expand access to health and social services. Instead, the legislation pivots toward cost containment, shifting administrative and financial responsibility to states and private entities. Key policy shifts include:

- $1.2 trillion in Medicaid and ACA reductions over 10 years

- Work requirements for Medicaid and SNAP recipients aged 19–64 (effective by December 2026)

- Elimination of ACA auto-enrollment and enhanced subsidies by January 2027

- Ban on PBM spread pricing and new transparency mandates (starting January 2027)

- Tighter SNAP eligibility, projected to reduce benefits for approximately 5.8 million adults

These provisions aim to reduce federal expenditures but will likely fragment coverage pathways and introduce long-term strain on the nation’s public health and care delivery systems.

Public and Population Health: Reversing Progress

OBBBA introduces conditions that could reverse recent gains in access, prevention, and chronic disease control. Millions of Americans face simultaneous loss of insurance and social supports and most notably coverage through Medicaid and nutrition through SNAP. The result is a compounded risk to population health:

- CDC studies show that food insecurity increases the risk of type 2 diabetes, cardiovascular disease, and depression.

- SNAP participation has been associated with a 14% reduction in hospital admissions for diabetes (JAMA Internal Medicine).

- Young adults aged 19–29 are expected to face the largest increase in uninsurance.

Community health centers and local public health infrastructure may be especially affected, leading to gaps in maternal health, behavioral health, and immunization programs. These disruptions will disproportionately impact low-income and rural populations.

Sector Impacts: An Interconnected Disruption

While OBBBA affects each healthcare sector in unique ways, the most profound consequences will emerge from the interdependency of those impacts. As federal funding retracts and eligibility tightens, risk shifts across the ecosystem—forcing providers, payers, pharmacies, and manufacturers to adapt to a new operating reality that is more fragmented, more localized, and less predictable.

Providers: Margin Compression and Rising Demand

Hospitals, health systems, and community-based providers are on the front lines of this transition. With Medicaid funding capped and eligibility curtailed through work requirements and income verification, providers are preparing for a surge in uncompensated care and a decline in predictable reimbursement.

- The Urban Institute projects 11.8 million more uninsured Americans by 2034 under OBBBA, straining emergency departments and safety-net services.

- In Massachusetts alone, hospitals anticipate $364 million in annual Medicaid-related revenue losses, raising the likelihood of service cuts, staff reductions, or outright closures in vulnerable regions.

- Rural and critical access hospitals—already under financial stress—face an even steeper cliff as disproportionate share hospital (DSH) payments remain flat despite rising need.

Providers must now weigh how to maintain access for patients while managing financial headwinds and evolving community health needs.

Health Plans: Enrollment Volatility and Risk Concentration

Health plans face a dual challenge: managing a shrinking, higher-risk enrollment base and absorbing the administrative complexity of redetermination cycles and new eligibility compliance mandates.

- The expiration of ACA subsidies by 2027 will likely drive younger, healthier individuals out of the individual market, increasing adverse selection and medical loss ratios.

- Plans participating in Medicaid Managed Care must overhaul eligibility verification, reporting, and engagement processes to remain compliant and competitive.

- Payers may need to reevaluate benefit design, premium pricing, and provider contracting strategies to remain sustainable in the face of risk pool degradation.

Payers that fail to evolve may find themselves covering fewer people—but at significantly higher cost per member.

Pharmacy Channel: Volume Disruption and Reimbursement Realignment

Pharmacies, especially those serving Medicaid-heavy or lower-income geographies, face substantial economic headwinds.

- As insurance coverage and SNAP benefits decline, prescription fill rates are expected to drop, particularly for chronic maintenance medications and preventive therapies.

- PBM reforms under OBBBA eliminate spread pricing, compelling a shift to transparent, pass-through reimbursement models. While this improves payer visibility, it compresses margins for retail pharmacies, especially independents with less negotiating power.

- The added cost of contract renegotiation, system updates, and compliance tracking may lead to accelerated consolidation, leaving fewer access points for high-need communities.

Pharmacies will need to expand their role through clinical services, affordability navigation, and care coordination to remain viable and relevant in a leaner coverage landscape.

Life Sciences: Access Barriers, Demand Shifts, and Pipeline Pressure

For the life sciences sector, OBBBA introduces both commercial disruption and strategic inflection. As Medicaid and ACA coverage contracts, so too does the payer-backed demand for therapies that rely heavily on public program access.

- Utilization for publicly funded therapies especially in chronic and rare diseases is likely to decline, reducing adherence and persistence rates across key indications.

- Medicaid drug pricing reforms and rebate recalculations will put downward pressure on net pricing and require renewed vigilance in gross-to-net management.

- For launch-stage products, particularly in oncology, rare disease, and primary care categories, coverage gaps could delay uptake and trigger more aggressive payer gatekeeping.

- Manufacturers will face increased demand for real-world evidence and HEOR that can demonstrate both outcomes and economic value in an era of fiscal scrutiny.

- Over the longer term, early-stage pipeline decisions may shift, with companies deprioritizing assets that lack strong commercial pathways outside of Medicaid or the exchanges.

The post-OBBBA era requires life sciences leaders to reimagine their access strategy, elevate cross-functional readiness, and identify new pathways to ensure that innovation still translates into patient impact.

Timeline for Implementation

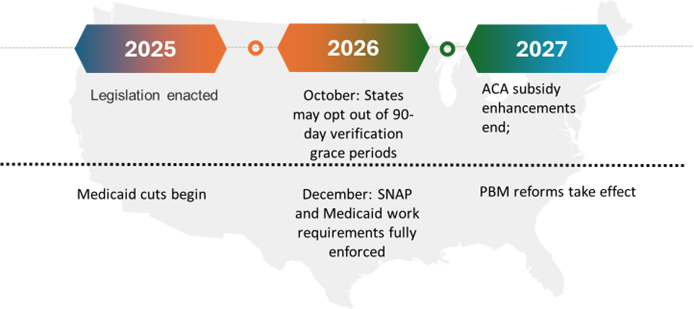

OBBBA provisions are structured for staged implementation through 2027. Key milestones include:

This timeline creates a rolling wave of policy changes, requiring coordinated planning and sustained adaptation from all stakeholders.

Cross-Sector Cascade Effects

Beyond discrete disruptions, OBBBA introduces ripple effects that will compound pressure across the ecosystem.

These dynamics heighten the need for integrated, system-wide responses that anticipate second-order impacts and avoid unintended gaps in care.

Strategic Considerations for Health Leaders

As OBBBA reshapes the health landscape, leaders must position their organizations for sustained adaptability and performance. Key priorities by sector include:

| Providers | Health Plans | Life Sciences |

| · Conduct financial impact assessments across service lines to understand exposure to Medicaid and SNAP changes.

· Redesign operating models to accommodate increased uncompensated care and expanded low-cost access points (e.g., urgent care, virtual, mobile).

· Build transformation roadmaps to adapt care delivery models to new economic and regulatory conditions.

|

· Evaluate redetermination readiness and assess administrative infrastructure to manage Medicaid churn and ACA disenrollment.

· Redesign product and network strategy in response to new risk dynamics and shifting member demographics.

· Develop integrated affordability strategies that align benefits, subsidies, and care navigation tools for vulnerable populations.

· Support PBM contract analysis and optimization as transparency and pricing models evolve.

|

· Assess product-level exposure to Medicaid and SNAP-driven demand disruption.

· Recalibrate launch sequencing and access planning for therapies tied to public payer utilization.

· Strengthen value communication through real-world evidence, health equity metrics, and pricing strategy refinement.

· Facilitate cross-functional readiness assessments to align market access, policy, and field teams under new reimbursement expectations.

|

Across all sectors, coordinated action, policy engagement, and data-driven decision-making will be essential to navigating the post-OBBBA environment.

The One Big Beautiful Bill Act is not a temporary change; it is a structural realignment. By shifting risk away from federal systems and toward providers, payers, pharmacies, and manufacturers, OBBBA redefines how the US health industry operates, funds, and delivers care. While uncertainty is high, this moment presents a critical opportunity to build greater resilience, responsiveness, and collaboration across the healthcare ecosystem.

At Vynamic, we believe this is the time to pause with purpose of assessing the strategic impact, scenario plan for the ripple effects, and realign for sustainable growth. Our team is ready to help health industry leaders across sectors turn this policy shift into a strategic inflection point.

Endnotes

- Urban Institute. The Effects of the One Big Beautiful Bill Act on Health Insurance Coverage. July 2025.

- Massachusetts Health & Hospital Association. Financial Impact Analysis on Medicaid Cuts. June 2025.

- Kaiser Family Foundation. ACA Subsidy Expiration and Risk Pool Impact. May 2025.

- JAMA Internal Medicine. SNAP Participation and Diabetes Hospitalization Rates. 2022.

- Centers for Disease Control and Prevention. Food Insecurity and Chronic Disease Correlation. 2021.

- CMS Guidance on PBM Transparency Reforms under OBBBA. July 2025.

About Vynamic

Vynamic, an Inizio Advisory company, is a leading management consulting partner to global health organizations across Life Sciences, Health Services, and Health Technology. Founded and headquartered in Philadelphia, Vynamic has offices in Boston, Durham NC, New York, and London. Our purpose is simple: We believe there is a better way. We are passionate about shaping the future of health, and for more than 20 years we’ve helped clients transform by connecting strategy to action.

Through a structured, yet flexible delivery model, our accomplished leaders work as an extension of client teams, enabling growth, performance, and culture. Vynamic has been recognized by organizations like Great Place to Work and Business Culture Awards for being leaders and innovators in consulting, company culture, and health. Visit Vynamic.com to discover how we can help transform your

organization or your career.

Want to learn more? Get in touch!

Other insights.

Jump to a slide with the slide dots.

Scenario Planning Infographic

Boost launch readiness with scenario planning. Learn 5 steps to stay proactive in today’s unpredictable market. Download the infographic.

Read more Brian Stamm

Brian Stamm

AI-Powered Decision Making to Simplify Your Launch Journey: Vynamic Experts on LaunchNav

LaunchNav by Inizio simplifies pharma launches with AI-driven insights, real-time benchmarks, and 800+ launch learnings.

Read more Prathima Guniganti

Prathima Guniganti

POV: Ensuring AI-Powered Omnichannel Strategies Deliver Expected Results

Learn how to optimize AI-powered omnichannel strategies for better engagement, data governance, and measurable results in life sciences

Read more