The rise of primary care: Leading the convergence movement

With contributions from: Ryan Hummel

Primary care – the newest, oldest trend in medicine. Over the last decade the primary care market evolved before our eyes, as dozens of new firms entered the marketplace and lured billions from Wall Street and private equity alike. In 2021 alone, $16 Billion in capital was raised by new Primary Care Physician (PCP) entrants, a 1,000x increase over the $15 Million raised a decade earlier in 2010.1,2

While operating models vary, new firms are philosophically aligned around the same mission – utilize PCPs as the quarterback to drive clinical and financial value. Most notably, this rise in prominence defies historic stereotypes, as PCPs are no longer being viewed as perfunctory, “bread and butter” practitioners. Rather, they are the physicians leading the charge in the health industry’s most novel development – wholistic convergence.

The business side of primary care is in the midst of a renaissance, with companies gaining massive valuations and industry titans like Amazon, CVS, and Walmart all shelling out billions to get in on the action.3,4,5

The reason behind this activity is simple: the primary care market possessed all the requisite ingredients for disruption.

- First, primary care physicians have proven their ability to drive value by improving outcomes and reducing costs.6

- Second, primary care was underinvested in the US, especially in comparison to other developed countries.7

- Third, new technologies and advancements in data interoperability have improved PCPs’ ability to orchestrate a patient’s plan of care.

- Fourth, and perhaps most importantly, the market experienced a maturation of financial models which reward organizations for reducing the overall cost of care. Taken all together, primary care was poised to explode.

What’s additionally interesting, this explosion in primary care is symptomatic of a broader trend: the convergence of the industry at large. To understand how primary care is leading convergence, let’s first identify what this means. Simply put, convergence is the deterioration of historic dividing lines, with industry powerbrokers (payers, providers, purchasers, etc.) now venturing outside of their traditional encampments in search of opportunities to create value and obtain market share. Primary Care Physicians, who sit at the confluence of the industry’s largest revenue streams, have recognized this advantageous positioning and are leading convergence through a number of innovative and value-based operating models.

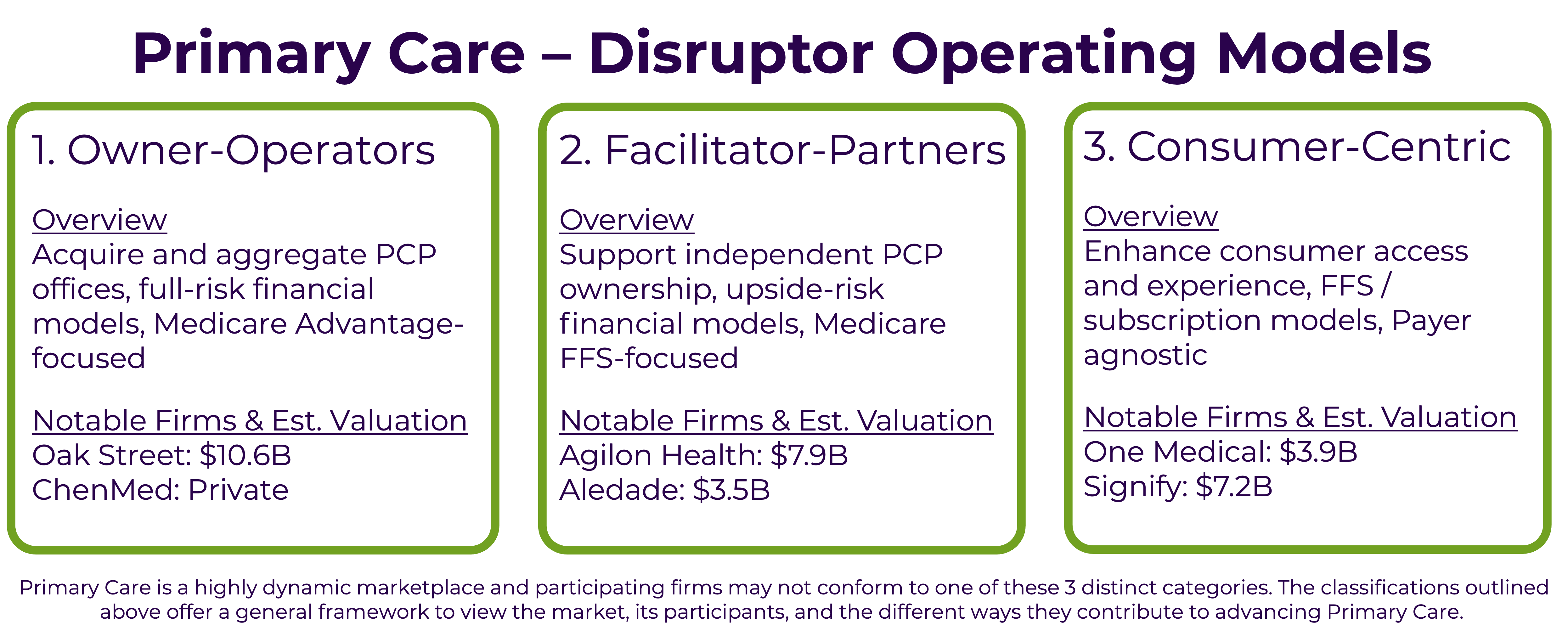

To better understand these operating models, we’ve performed an analysis of the firms leading the movement, including an assessment of their financial structures, business segmentation, and overall impact on the marketplace. Through this analysis we’ve identified 3 preeminent cohorts of primary care players:

One of the biggest developments in primary care has been the rise of Owner-Operator business models. These firms develop and/or purchase independent primary care clinics to employ physicians directly. This aggregation creates value by providing economies of scale advantages, as fixed operating costs can be spread across a larger clinical network. Owner-Operators tend to focus on urban environments where they can efficiently cater to underserved Medicare beneficiaries. These members often have multiple comorbidities and a higher acuity in comparison to average beneficiaries, making them a great candidate for comprehensive case management. While Owner-Operator clinics may look similar to other physician offices, they operate under a financial model that is considerably different as they assume full-risk for their attributed lives. Meaning, if their PCP-driven model of care does not reduce the total cost of care, they stand to lose money. It’s a big bet, however. If they’re successful in managing chronic conditions and improving health outcomes, they alone benefit on the financial upside.

Due to the capitated nature of this arrangement, Owner-Operators work with payers who market, enroll, and collect the premium revenue. Growth amongst Owner-Operators has been buoyed by the fact that their payer partners love this business model, as it reduces the payer’s clinical management responsibilities and ensures a certain level of profitability. The Affordable Care Act requires Insurers spend 85% of their revenue on healthcare costs, which leaves the remaining 15% for administrative expenses and profits. Traditionally, if a payer underperforms and has an MLR higher than 85%, every dollar over this ratio eats into the payer’s profit margin. Owner-Operators effectively remove this operational risk and help the payers ensure a certain level of profitability.

Facilitator-Partners are another model of PCP disruption that has grown significantly over the last decade. Like Owner-Operators, these organizations create value by empowering and supporting primary care physicians; however, their operating model is considerably different. Facilitators don’t seek to own primary care practices; rather, they see tremendous value in keeping PCP practices independently owned. This approach counters industry headwinds, as an increasing percentage of primary care practices are being acquired by hospital groups and private equity firms.8,9 Another difference is, while Owner-Operators’ core business focuses on Medicare Advantage, Facilitators target Medicare FFS and support beneficiaries within Medicare’s Shared Savings Program for Accountable Care Organizations (ACO’s).

Although building an ACO comprised of disparate PCP clinics is complex, the value proposition to physicians is compelling. Facilitator-Partners offer PCPs an opportunity to stay independent, as well as the ability to increase their compensation, all by doing more of what they went to medical school for – making people healthier. Once more, unlike hospital-sponsored ACOs, PCP-anchored models enable physicians to increase their compensation through multiple revenue streams. This is accomplished by the way ACOs are structured, as they create value by reducing the overall cost of care for a specific patient population. The best way to reduce the cost of care is to minimize inpatient admissions (i.e., surgeries, ED visits) and other types of high-cost and preventable utilization. High-cost medical utilization is reduced by proactive primary care teams who see their patients more frequently. Thus, PCPs make more money on the front end through a higher volume of patient encounters, and then on the back end through bonus pools when the total cost of care is lowered relative to benchmark. Facilitators help to ensure success by providing independent PCPs with technology tools, regulatory advocacy, as well as administrative and back-office support.

The third cohort gaining traction in the evolving PCP market is Consumer-Centric organizations. These companies are structured differently to Owner-Operators and Facilitator-Partners in that their revenue is often not risk-based. Rather, Consumer-Centric firms create value by minimizing customer friction and making primary care as accessible and convenient as possible. They do so through a variety of tactics, including embedding clinics within highly visited retail locations. Evidence of their momentum, mainstay retailers like CVS, Walgreens, Walmart, and Target are all dedicating square footage to primary care. The value proposition is simple: healthcare is a commodity, so make access to this commodity as convenient as possible to help capture demand. A second strategy used to enhance consumer experience is the in-home encounter approach. Firms here will contract directly with payers to perform outreach and in-home health visits that are designed to be convenient for the patient, as well as comprehensive for the payer, as the insights gleaned are relayed back to the payer so they can actualize a care plan based on the unique needs of each beneficiary.

Consumer-Centric companies also leverage technology to make physician engagement as easy as possible. It’s no secret that digital health solutions have taken off in recent years, with primary care being a leader in this space. Most notably, PCPs have recognized and adopted digital solutions at a significantly higher clip than their specialist counterparts.10Another differentiating factor for Consumer-Centric firms is they participate on a fee-for-service basis across all business segments, including Medicare, Medicaid, commercial, and self-pay. In addition to their FFS reimbursement, many consumer companies offer a subscription-based concierge model where patients pay on a monthly fee for an ongoing membership. These arrangements provide patients with an exceptional level of care access, including 24-7 PCP availability as well as enhanced care coordination amongst specialists.

Summary

Primary care constitutes roughly 6% of US healthcare spend and has an estimated market value of $266 Billion.11,12 When compared to the US healthcare market as a whole, which is estimated at $4.3 Trillion, primary care is a drop in the bucket. However, market value is not why the sector is being disrupted. It’s being disrupted because of primary care’s market control. Market control, which is the ability to influence medical spend outside of one’s individual silo, is the core tenant supporting PCPs’ ability to lead industry-wide convergence.

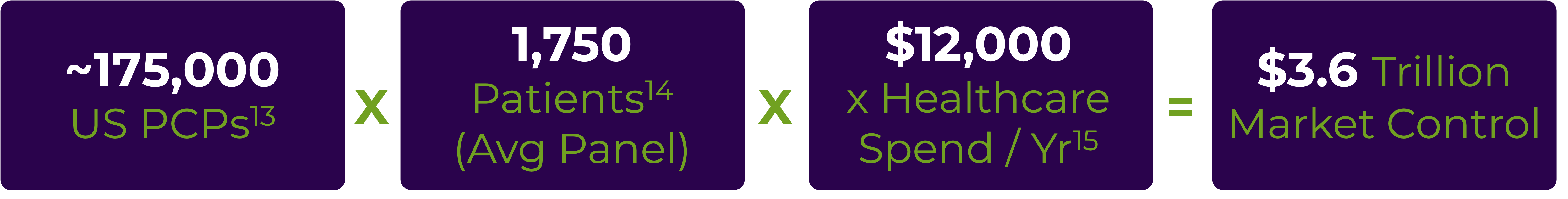

To illustrate the valuation of PCPs’ market control, we used industry standard assumptions regarding patient panels & annual health care expenses:

As evidenced above, PCPs possess more than $3 Trillion in market control, which is approximately 75% of the total healthcare industry, as well as ~15% of the entire US GDP. This is why primary care has become a Wall Street darling, and one of the hottest tickets in healthcare finance. In fact, primary care investments are outpacing that of other (much larger) industry segments, including acute care hospital facilities.13

As industry power brokers continue to respond to market influences and converge, primary care physicians will be a key player in this evolution. Now only one question remains, given the surge in urgency for primary care providers: Will there be enough PCPs to support the industry’s growing demand? Join us next time, as we discuss the supply side of the primary care marketplace, as well as what’s being done to ensure adequate PCP access for years to come.

At Vynamic, we offer a range of services through an integrated approach to adopting new initiatives. These include value-based contracting advisory, clinical operations and workflow support, digital transformation, and business-case development. Contact us to find out how Vynamic can support a current assessment of your provider or payer organization and develop a roadmap for Value Based Care contracting.

Related Content:

- https://vynamic.com/insights/breaking-boundaries-the-convergence-evolution/

- https://vynamic.com/insights/closing-the-gap-making-digital-health-more-equitable/

End notes:

- Bloomberg. (2022, February). Medicine’s Worst-Paying Specialty Is Luring Billions from Wall Street.

- New England Journal of Medicine. (2021, November). Private Equity and Primary Care: Lessons from the Field.

- Advisory Board. (2023, February). Amazon + One Medical: $3.9B Deal Officially Closes.

- PBS. (2023 February). CVS Buys Primary Care Provider Oak Street for $10.6 billion.

- KFF Health News. (2023, March). Walmart Health to Nearly Double Its In-Store Clinics in 2024.

- The American Journal of Medicine. (2010, March). We Can Reduce US Health Care Costs.

- Tikkanen, R., & Abrams, M.K. (2020, January). U.S. Health Care from a Global Perspective, 2019: Higher Spending, Worse Outcomes? Commonwealth Fund.

- JAMA Health Forum. (2022 September). Association of Private Equity Acquisition of Physician Practices with Changes in Health Care Spending and Utilization.

- American Medical Association (AMA). (2020, February). Physicians’ Motivations and Requirements for Adopting Digital Health Adoption and Attitudinal Shifts from 2016 to 2019.

- The Commonwealth Fund. (2022, March). Increasing Medicare’s Investment in Primary Care.

- Grand View Research. (2023, February). U.S. Primary Care Physicians Market Size, Share & Trends Analysis Report.

- McKinsey & Company. (2022, December). Investing in the New Era of Value-Based Care.

About Vynamic

Vynamic, an Inizio Advisory company, is a leading management consulting partner to global health organizations across Life Sciences, Health Services, and Health Technology. Founded and headquartered in Philadelphia, Vynamic has offices in Boston, Durham NC, New York, and London. Our purpose is simple: We believe there is a better way. We are passionate about shaping the future of health, and for more than 20 years we’ve helped clients transform by connecting strategy to action.

Through a structured, yet flexible delivery model, our accomplished leaders work as an extension of client teams, enabling growth, performance, and culture. Vynamic has been recognized by organizations like Great Place to Work and Business Culture Awards for being leaders and innovators in consulting, company culture, and health. Visit Vynamic.com to discover how we can help transform your

organization or your career.

Want to learn more? Get in touch!

Other insights.

Jump to a slide with the slide dots.

Matthew Howard

Matthew Howard

Closing the gap: Making digital health more equitable

At Vynamic, we’re advocates for diversity, equity, and inclusion (DEI) in healthcare. We believe there are several actions those in the healthcare.

Read more Mindy McGrath

Mindy McGrath

Breaking boundaries: The convergence evolution

Read how organizations are embracing convergence through technology and partnerships to deliver more accessible and personalized care.

Read more