Health plans: Big bets for convergence & strategic capital diversification

The last decade has witnessed widespread consolidation in the US health plan market as insurers look to grow membership and stakeholder value, while reducing costs and driving the quality of care.

This concentration has taken a number of different forms. There have been joint ventures, such as Blue Cross Blue Shield’s partnership with Honest Medical Group, aiming to make it easier for doctors to switch to value-based care for Medicare patients. We’ve also seen insurers join with pharmacies and providers, creating vertically integrated value chains designed to offer more unified care and stronger financial benefits. And we’ve witnessed more traditional horizontal mergers and acquisitions, such as Anthem’s purchase of Integra Managed Care in May 2022, which will expand the former’s Medicaid business and coverage to support long-term care needs in the home.

Payers in general – especially large, national insurers – found themselves in a strong position in 2021 and 2022 due to the fact that many fared well financially during the pandemic, benefitting from lower utilization across the board. But as 2022 draws to a close, there are challenges afoot that could threaten even the most established health insurer. High inflation, rising interest rates, and general economic turmoil could lead to a reduction in employer-based insurance enrollment and increased healthcare costs, squeezing payers from both ends of the income statement.

We believe that those best positioned to weather the storm and succeed over the coming years will be the payers who use their strategic capital to diversify. Based on the industry trends and results we’ve seen, we believe every insurer should be investing in the following three key areas in 2023.

1. Whole healthcare delivery and financing

The last few years have seen a more holistic, personalized approach to healthcare, one that aims to move beyond treating conditions in isolation and towards greater understanding of treating the person as a whole.

To some extent, this has been reflected in the payer market. Some member health plans are now going further than solely paying for and coordinating primary medical care, and are now integrating behavioral care into plans. Recently, industry trade body AHIP said insurers were committed to “further improve access to mental health care and substance use disorder treatment for every American.” Many payers are now folding mental healthcare into plans and introducing “solutions that are working to expand access, promote quality and value, promote parity, advance equity, and improve the experience for patients and their families.”

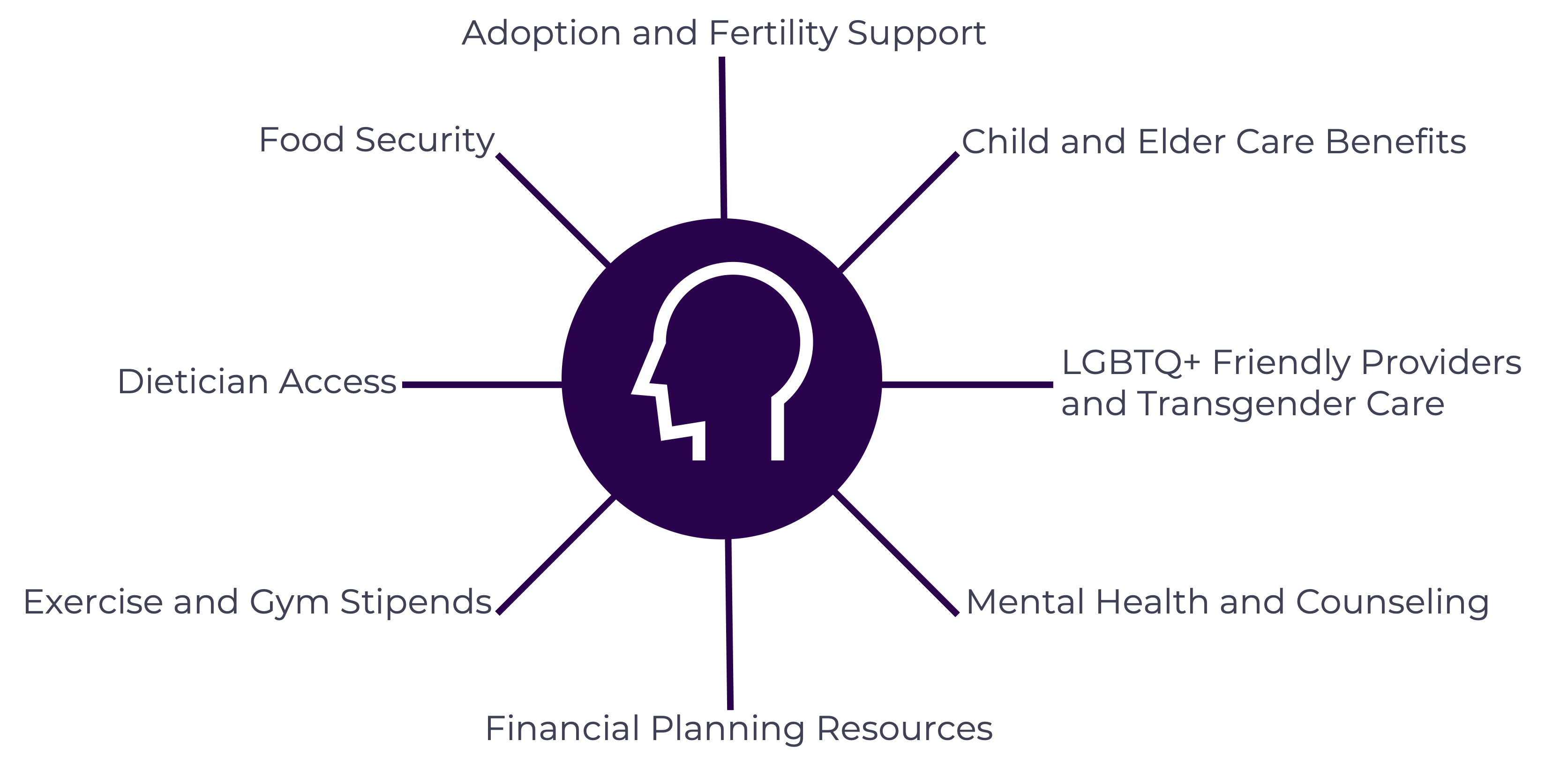

It’s not just mental health that’s now being included. Insurers are increasingly integrating a wide range of care, from dental and eye care, to conditions connected to the social determinants of health, including income, education, race, and more (see figure below).

Broader benefits now covered across health plans

The challenge for health plans is how to do this well enough to create a seamless and effective member experience, whether through building that capability in house or via acquisitions.

Both routes offer complexities in terms of delivery, financial alignment, and ensuring data integration to get a 360-degree view of the patient. Health plans will need to consider the costs of such a move, the business-transformation process, and new strategies and operating models if they’re to deliver the experience members are looking for – and the value stakeholders demand.

2. Provider partnerships

As noted, the market has moved towards consolidation, with one option being the vertical integration of health plans, pharmacies, and providers. But another route for payers is to form mutually beneficial contractual partnerships.

Typically, these collaborations can offer multiple benefits for both parties. These include membership growth, geographic expansion, increased innovation for health plans, improved clinical outcomes, and the easing of healthcare access limitations for providers. A common motivation for partnerships across both stakeholders includes improved performance in Value Based Contracting, which as referenced in the below figure is dependent on a wide variety of factors.

However, in Vynamic’s opinion, too often both parties are primarily driven by a prospective increase in volume (if the provider is initiating the collaboration) or control over utilization (if it’s the health plan in the driver’s seat). We believe the best way to unlock both is to start by putting the member first in order to elevate their care and experience.

By designing a provider-health-plan partnership with a member-centric approach, health plans can present a truly differentiated solution that looks and feels different to the patient-member. However, such a move may require a significant shift in cultural mindset and integration, as well as clearly defined risk-sharing agreements, if it’s to ensure long-term success with both parties benefiting.

Keys to success in value-based care

Member experience should increasingly factor into Health Plan/Provider partnerships.

3. Virtual-first products

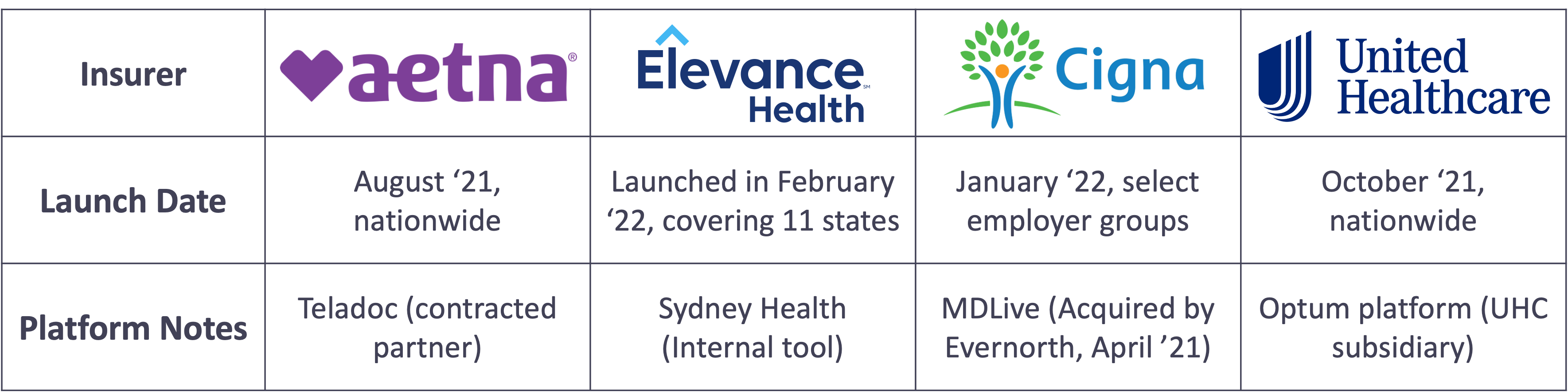

COVID accelerated a shift towards more digitally focused health interactions. But although some traditional health plans stopped covering virtual care as the country got over the worst of the pandemic, we have since begun to see the emergence of more virtual-first health plans.

Virtual-first models – policies that prioritize initial care interactions remotely – are particularly appealing to employers with nationally distributed remote workforces. That’s because they remove the need to find plans that cover such geographically dispersed employees.

More than a dozen virtual-first plans were launched in 2021, as insurance firms recognized how they can offer members more flexibility, while reducing costs by diverting care from more expensive settings. Those costs are not insignificant; it’s estimated around $250B of healthcare spend could potentially move online.

Payers of all sizes continue to experiment with virtual-first products

14+ multi-state, virtual-first health plans announced (as of 2021)

As technology advances and more people become digitally literate, we believe there’s tremendous scope for virtual-first products. But the move won’t be without its difficulties for many payers, in particular from a technology perspective as payers explore how best to connect members to healthcare providers.

Where moving to virtual-first is successful in increasing geography, health plans will also need to consider finding the right provider network to serve patients via remote interactions, but also contract with appropriate traditional networks to provide emergent and procedural care. There are also ambiguities around pricing to consider between payers and providers.

Making the move to differentiation

As consolidation in the health plan market continues at pace, companies find themselves looking for new ways to differentiate themselves. We believe those who don’t evolve to adopt current trends – such as offering whole-healthcare delivery, provider partnerships, and innovative virtual-first products – will find it increasingly difficult to compete in a strained economy.

Vynamic can help with the adoption of such initiatives, supporting health plan clients to build or refresh their strategic plans and manage their portfolios. As we’ve outlined above, each area offers significant benefits, but also numerous challenges that will need to be navigated carefully if they’re to be implemented and run efficiently.

Any investment must take into consideration the financial considerations of such a move, including whether to build in-house capacity or acquire it, and the investment payback period required, both internally and with shareholders.

At Vynamic, we offer a range of services through a seamless, joined-up approach to adopting new initiatives. These include business-case development, capital portfolio planning, acquisition integration support, cultural transformation, systems migration and rationalization, and value realization and ROI tracking.

References:

- “Health Insurers Keep Consolidating. Here Are The Potential Side Effects for Consumers And Start Ups” CB Insights. April 11, 2019.

- “Insurers + PBMs + Specialty Pharmacies + Providers: Will Vertical Consolidation Disrupt Drug Channels in 2020?”. Drug Channels. December 12, 2019.

- Anthem closes acquisition of Integra Managed Care”. Fierce Healthcare. May 9, 2022.

- “U.S. Health Insurance Industry Analysis Report”. National Association of Insurance Commissioners. 2021 Annual Results.

- “Health Insurance Lobby Rolls Out Mental Health Goals As ‘Whole Person Care’ Takes Hold”. Forbes. August 23, 2022.

- “Virtual-First Products: Virtual Provider was developed in-house”. Advisory Board.

- “Virtual-first health plans are here. Can they exist on their own?”. Becker’s Payer Issues. June 8, 2022.

About Vynamic

Vynamic, an Inizio Advisory company, is a leading management consulting partner to global health organizations across Life Sciences, Health Services, and Health Technology. Founded and headquartered in Philadelphia, Vynamic has offices in Boston, Durham NC, New York, and London. Our purpose is simple: We believe there is a better way. We are passionate about shaping the future of health, and for more than 20 years we’ve helped clients transform by connecting strategy to action.

Through a structured, yet flexible delivery model, our accomplished leaders work as an extension of client teams, enabling growth, performance, and culture. Vynamic has been recognized by organizations like Great Place to Work and Business Culture Awards for being leaders and innovators in consulting, company culture, and health. Visit Vynamic.com to discover how we can help transform your

organization or your career.

Want to learn more? Get in touch!

Other insights.

Jump to a slide with the slide dots.

Scenario Planning Infographic

Boost launch readiness with scenario planning. Learn 5 steps to stay proactive in today’s unpredictable market. Download the infographic.

Read more Brian Stamm

Brian Stamm

AI-Powered Decision Making to Simplify Your Launch Journey: Vynamic Experts on LaunchNav

LaunchNav by Inizio simplifies pharma launches with AI-driven insights, real-time benchmarks, and 800+ launch learnings.

Read moreThe One Big Beautiful Bill Act: Implications for the U.S. Health Industry

OBBBA reshapes U.S. healthcare with $1.2T cuts, shifting risk to providers, payers, and pharma. Explore impacts and strategies.

Read more