The new era of drug pricing is here: Are you ready?

Authored by: Mindy McGrath & Caroline Frantz

The anticipation of the Inflation Reduction Act’s key provisions is causing significant shifts in the healthcare industry, forcing Life Sciences and Health Plans to rethink their business strategies. This Act, a landmark move by Congress on clean energy and climate change, also aims to control Medicare costs, reduce prescription drug prices, and expand pharmaceutical access for millions of Americans. Projected to save the government approximately $200 billion by 20311 through reduced consumer prices, these savings will impact manufacturer revenues and health plans. Now is the time for Life Sciences and Health Plans to assess this new regulatory landscape and prepare accordingly.

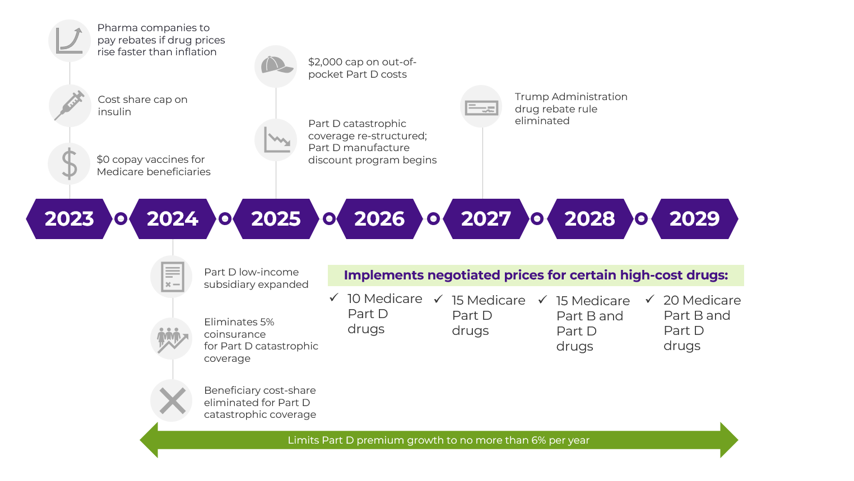

Over the next six years the provisions outlined in the Inflation Reduction Act will continue to unfold. Starting in 2023, Life Sciences organizations began to see the impact of some of these provisions, most notably with the requirement that they pay rebates if the price of their drugs rise faster than the rate of inflation. Additional provisions to come include negotiated prices for certain high-cost drugs, specifically a list of single-source (i.e., no available generic or biosimilar) drugs and a specific number of drugs based on top Part B and Part D expenditures. Life Sciences companies must now consider launching therapies at higher price points to maximize early revenue.

Current and Forward-Looking Provisions of the Inflation Reduction Act

These provisions are aimed at government negotiation of drug prices, rebates for exceeding inflation increases, and a cap on insulin costs for Medicare beneficiaries; the act directly impacts both revenue streams and market access. With these impacts, there is a need for recalibration of revenue expectations and strategic plans, considering the potential impact on sales volumes, market share, and overall revenue streams Specifically, life sciences organizations will see significant impacts due to:

- Medicare Drug Price Negotiation

The Medicare Drug Price Negotiation provision in the Inflation Reduction Act allows Medicare to negotiate the prices of certain high-cost prescription drugs, which could reduce revenue for pharmaceutical companies by lowering drug prices. This could lead to a decrease in funds available for research and development within life sciences organizations, potentially impacting innovation, and the development of new therapies. - Inflationary Rebates

The introduction of inflationary rebates directly impacts Life Sciences organizations by limiting their ability to increase drug prices beyond the inflation rate, which in turn restricts potential revenue growth from existing products. There is an enhanced need to re-evaluate pricing models in response to caps on annual price increases; specifically exploring alternative pricing models to navigate constraints while maintaining profitability and competitiveness. - Medicare Part D Redesign

The Medicare Part D redesign restructures the payment and coverage model, which includes a cap on out-of-pocket costs for beneficiaries and shifting more cost burden onto payers to absorb the coverage gap. Health Plan reaction to additional cost burden may lead to increased formulary management along with an increased demand for a rigorous value story on products to increase market access opportunities.

While remaining agile and adaptable during the evolving landscape, Life Sciences companies must balance strategic innovation and rapid market entry to optimize product revenue potential. The Inflation Reduction Act, as Mindy McGrath’s article Seizing the moment: the life sciences industry at the threshold of change (PharmaPhorum) states: “…compels pharmaceutical leaders to exercise strategic foresight and adaptability, and to rebalance portfolios to focus on growth”. Now is the time for leaders to focus their attention on strategic agility, innovation, and collaboration to sustain long-term growth and competitiveness.

The provisions in the Inflation Reduction Act will also have a seismic impact on Health Plans, most notably due to the changes aimed at making healthcare more affordable and accessible for Medicare members. These changes will necessitate adaptations in business models and operations to align with the new regulatory landscape. The notable impact health plans organizations will see are due to the following major provisions and resulting impacts:

- Out of Pocket Caps

The introduction of a $2,000 out of pocket cap for all Medicare members will create a significant lift for Health Plans as they are forced to absorb more liability and potentially re-evaluate formularies, while keeping star ratings high. This might necessitate adjustments in premium pricing, benefit design, or cost management strategies to offset the higher costs associated with capping out-of-pocket expenses for beneficiaries - Medicare Prescription Payment Plan “Smoothing” Provision

The Medicare Prescription Payment Plan or “smoothing” provision in the Inflation Reduction Act, which allows Medicare Part D beneficiaries to spread out their out-of-pocket costs over the year, impacts Health Plans by increasing administrative complexity and potentially delaying revenue collection. Health plans may need to adjust their financial and operational strategies to manage cash flow and ensure they can accommodate the new payment schedules while maintaining their financial stability while also ensuring that Star ratings for member experience are enhanced rather than negatively impacted by this significant provision. - Prescription Drug Negotiation

Over the course of multiple years, Part B and Part D drug prices will be negotiated which will reduce overall expenditure on prescription drugs for health plans, leading to potential savings that could be passed on to consumers in the form of lower premiums or out-of-pocket costs, but it may also require adjustments in contracts with pharmaceutical manufacturers and changes in formulary management. Any changes made to benefit design and/or formulary decisions will encourage plans to think about connectivity between star ratings & customer experience.With these anticipated changes and provisions in mind, it is paramount that leaders across the healthcare industry begin to understand and plan for impacts to their businesses. The IRA marks a significant shift in the pharmaceutical and payer landscape. To navigate this evolving environment, healthcare industry leaders must be prepared. Proactive strategizing is crucial to ensure long-term viability, from potential pricing adjustments to reevaluating R&D priorities. A clear understanding of the act’s intricacies and its ripple effects on health plans is vital for developing effective adaptation plans. The following survey aims to gauge your current level of understanding and preparedness, empowering you to make informed decisions in this dynamic new landscape.

Survey

Score yourself on a scale of 1-5 (5: strongly agree, 1: strongly disagree) on the following 7 questions. Your final (sum) score will help to inform any necessary action to prepare for impacts of the Inflation Reduction Act

- Understanding of Key Provisions:How confident are you in your understanding of key provisions within the Inflation Reduction Act that impact both Life Sciences organizations and Medicare sponsored Health Plans?

- Impact Assessment: How confident are you in your organization’s assessment of the potential strategic, operational, and financial impact of the Inflation Reduction Act?

- Strategic Planning: Where is your organization/portfolio/brand in terms of solid strategies (1-3 year outlook) to account for the implementation and ongoing rollout of the Inflation Reduction Act’s key provisions.

- Communication & Change Management: How confident are you in your organization’s ability to manage and communicate any organizational or operating model changes to all stakeholders, in the context of the Inflation Reduction Act?

- Planning: Do you have a comprehensive plan in place to mobilize on the provision outlined in the IRA?

- For Life Sciences Organizations: Do you have clarity on the provisions required of health plans and how those may impact formulary policy and subsequently market access?

- Overall Readiness: Considering all aspects, how confident are you in your organization’s overall readiness to navigate the challenges and opportunities presented by the Inflation Reduction Act?

Implementation of the IRA is already underway and over the next few years, significant changes will reveal themselves. Impacts from these changes will reverberate across the health industry. To continue the conversation and seek to understand how Vynamic can help you navigate this disruptive policy, reach out today.

Source:

- The Henry J. Kaiser Family Foundation. (2023, March 1). FAQs about the Inflation Reduction Act’s Medicare drug price negotiation program. KFF. https://www.kff.org/medicare/issue-brief/faqs-about-the-inflation-reduction-acts-medicare-drug-price-negotiation-program/

About Vynamic

Vynamic, an Inizio Advisory company, is a leading management consulting partner to global health organizations across Life Sciences, Health Services, and Health Technology. Founded and headquartered in Philadelphia, Vynamic has offices in Boston, Durham NC, New York, and London. Our purpose is simple: We believe there is a better way. We are passionate about shaping the future of health, and for more than 20 years we’ve helped clients transform by connecting strategy to action.

Through a structured, yet flexible delivery model, our accomplished leaders work as an extension of client teams, enabling growth, performance, and culture. Vynamic has been recognized by organizations like Great Place to Work and Business Culture Awards for being leaders and innovators in consulting, company culture, and health. Visit Vynamic.com to discover how we can help transform your

organization or your career.

Want to learn more? Get in touch!

Other insights.

Jump to a slide with the slide dots.

Direct by Design: How Pharma Can Lead the Future of Patient Experience and Interoperability

Discover how pharmaceutical companies can enhance patient experience and interoperability through direct-to-patient (DTP) models.

Read moreScenario Planning Infographic

Boost launch readiness with scenario planning. Learn 5 steps to stay proactive in today’s unpredictable market. Download the infographic.

Read moreAI-Powered Decision Making to Simplify Your Launch Journey: Vynamic Experts on LaunchNav

LaunchNav by Inizio simplifies pharma launches with AI-driven insights, real-time benchmarks, and 800+ launch learnings.

Read more